Fica Tax Rate For Employers 2024

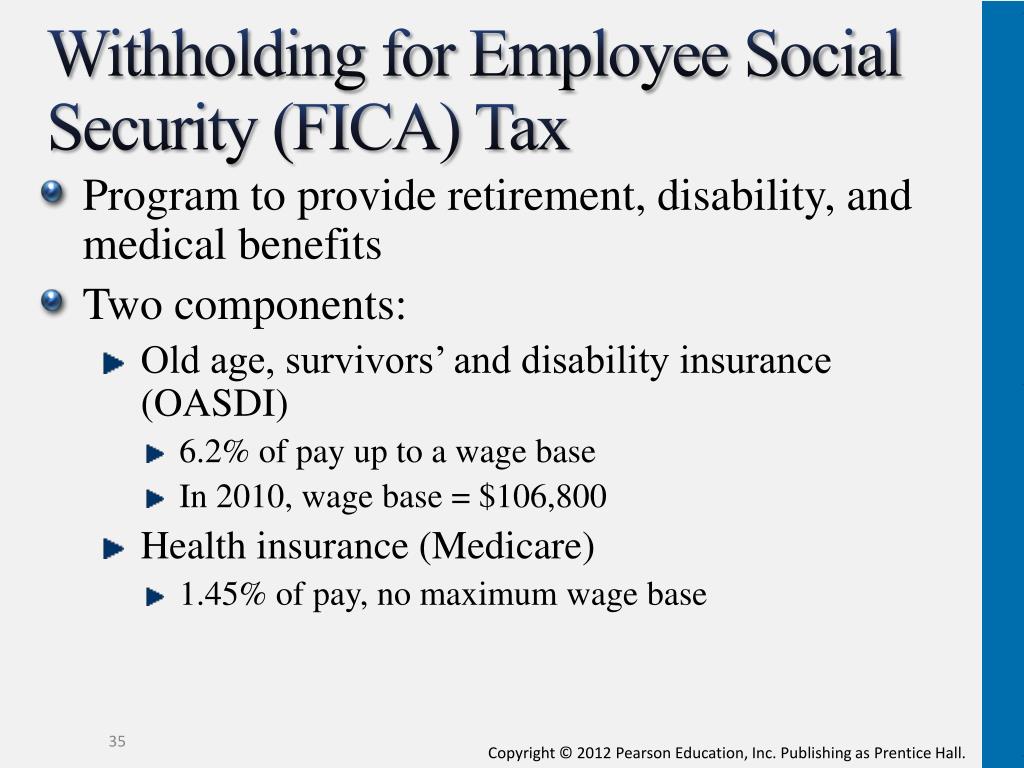

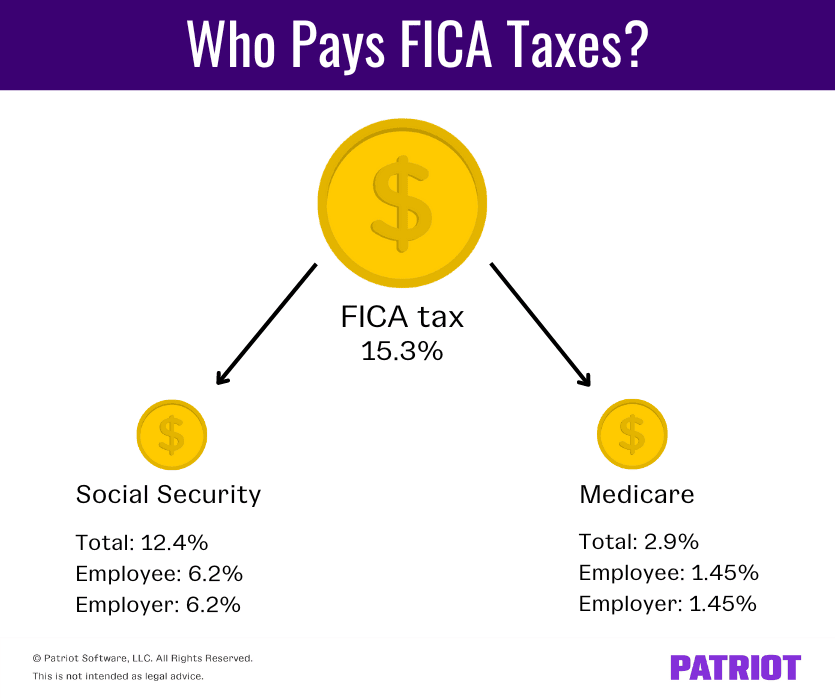

Fica Tax Rate For Employers 2024. The employer fica rate is 7.65% in 2024. Fica taxes have two main parts:

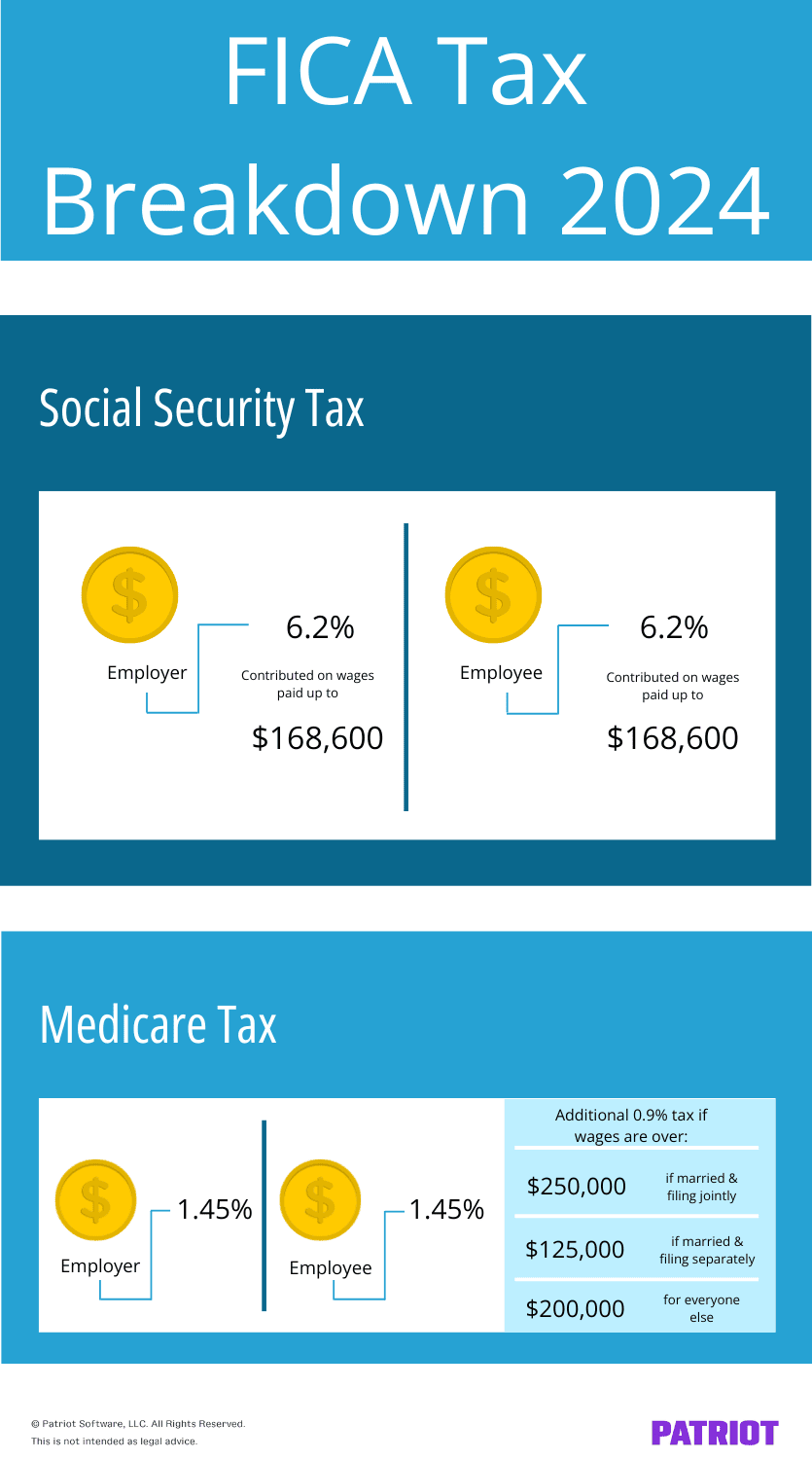

Possible cut to fica taxes in 2024. The social security wage base limit is $168,600.the medicare tax rate is.

The Social Security Wage Base Limit Is $168,600.The Medicare Tax Rate Is.

As of 2024, employers and employees each pay 6.2% for social.

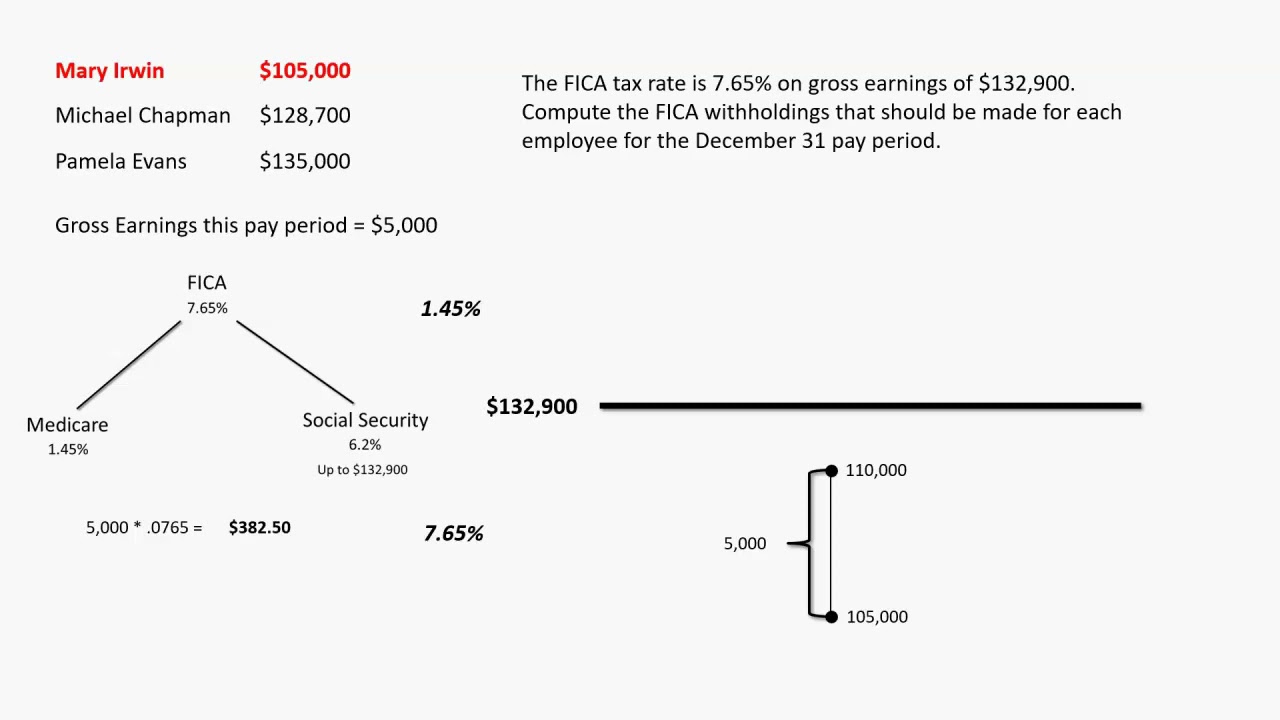

For 2024, The Fica Tax Rate For Employers Will Be 7.65% — 6.2% For Social Security And 1.45% For Medicare (The Same As In 2023).

What are the fica rates and limits for 2024?

To Calculate Fica (Federal Insurance Contributions Act) Taxes Follow These Steps.

Images References :

:max_bytes(150000):strip_icc()/fica-taxes-social-security-and-medicare-taxes-398257_FINAL-5bbd10af46e0fb00266df9ec-b3794e561e094118ad5b5ed3c6898880.png) Source: www.thebalancemoney.com

Source: www.thebalancemoney.com

Learn About FICA, Social Security, and Medicare Taxes, For 2024, the fica tax rate for employers will be 7.65% — 6.2% for social security and 1.45% for medicare (the same as in 2023). The total fica tax rate is 15.3%, which is split equally between employees and employers, each paying 7.65% of their income.

What is FICA Tax? The TurboTax Blog, Fica taxes include both social security and medicare taxes. Social security tax and the hospital insurance tax, also known as medicare tax.

Source: erctoday.com

Source: erctoday.com

2023 FICA Tax Limits and Rates (How it Affects You), Overall, the fica tax rate is 7.65%: It includes income from employment, bonuses, commissions, and other.

Source: medicare-faqs.com

Source: medicare-faqs.com

How To Calculate Fica And Medicare Tax Withholding, Attention to detail is important when discussing fica rates and limits, as they may change each calendar year. To calculate your fica tax burden,.

Source: www.bluestonesvc.com

Source: www.bluestonesvc.com

What Employers Need to Know About FICA Taxes BlueStone Services LLC, Social security tax and the hospital insurance tax, also known as medicare tax. Determine the social security tax:

Source: www.forbes.com

Source: www.forbes.com

What Are FICA Taxes? Forbes Advisor, Rates and thresholds for employers 2024 to 2025. For both of them, the current social security and medicare tax rates are 6.2% and 1.45%, respectively.

Source: www.youtube.com

Source: www.youtube.com

Calculating FICA Taxes YouTube, Rates and thresholds for employers 2024 to 2025. It includes income from employment, bonuses, commissions, and other.

Source: www.finansdirekt24.se

Source: www.finansdirekt24.se

Who Pays Payroll Taxes? Employer, Employee, or Both? (+ Cheatsheet, I ncome tax return filing: Attention to detail is important when discussing fica rates and limits, as they may change each calendar year.

Source: www.financialsamurai.com

Source: www.financialsamurai.com

Maximum Taxable Amount For Social Security Tax (FICA), Use these rates and thresholds when you operate your payroll or provide. This limit, known as the wage base limit, changes yearly based on inflation and is $168,600 in 2024.

Source: escblogger.com

Source: escblogger.com

What Are Payroll Taxes? Varieties, Employer Obligations, & Extra, The social security wage base is $168,600 for. Various factors determine this rate, and this article will cover them.

Social Security Tax And The Hospital Insurance Tax, Also Known As Medicare Tax.

Attention to detail is important when discussing fica rates and limits, as they may change each calendar year.

The Employer Fica Rate Is 7.65% In 2024.

Possible cut to fica taxes in 2024.